Profit and loss statements, also known as income statements, are essential financial tools for small businesses. They provide valuable insights into a company’s financial performance, indicating whether it’s making a profit or experiencing a loss. In this article, we will guide you through the process of creating and understanding profit and loss statements, focusing on examples that cater to small businesses, including restaurants. By the end, you’ll have a clear understanding of how to use these statements to evaluate your business’s financial health.

Table of Contents

1. Introduction

In this fast-paced business world, understanding financial statements is crucial for entrepreneurs and small business owners. One of the most vital financial statements is the profit and loss statement. In simple terms, it provides a snapshot of a business’s revenues, expenses, gains, and losses over a specific period. Let’s dive deeper and explore its significance.

2. What Is a Profit and Loss Statement?

A profit and loss statement, also known as an income statement, is a financial report that summarizes a company’s revenues, costs, and expenses during a specific period. It showcases the financial performance of a business, indicating whether it made a profit or incurred a loss.

3. Importance of Profit and Loss Statements

Profit and loss statements hold immense importance for small businesses. They help owners and stakeholders gauge the profitability of the company, identify areas of improvement, make informed decisions, and track financial progress over time. By analyzing these statements, businesses can take proactive measures to optimize their operations and increase their bottom line.

4. Components of a Profit and Loss Statement

A profit and loss statement consists of several key components:

Revenue:

Revenue represents the total income generated by a business through its primary operations. It includes sales revenue, service revenue, and any other sources of income directly related to the core business activities.

Cost of Goods Sold (COGS):

COGS includes the direct costs associated with producing or delivering the goods or services sold. This typically includes the cost of raw materials, direct labor, and manufacturing expenses.

Gross Profit:

Gross profit is calculated by subtracting the cost of goods sold (COGS) from the revenue. It reflects the profitability of the company’s core operations.

Operating Expenses:

Operating expenses encompass all costs incurred in running the day-to-day operations of the business. This includes expenses such as rent, utilities, salaries, marketing, and administrative costs.

Operating Income:

Operating income is obtained by subtracting the operating expenses from the gross profit. It shows the profit or loss generated from the company’s regular operations before considering other income and expenses.

Other Income and Expenses:

This category includes any additional income or expenses that are not directly related to the core operations of the business. It may include interest income, interest expenses, gains or losses from investments, or any extraordinary income or expenses.

Net Income:

Net income, also known as the bottom line, is the final figure obtained by subtracting all expenses, including taxes, from the operating income. It represents the profit or loss of the business during the specified period.

5. Creating a Profit and Loss Statement

To create a profit and loss statement for your small business, follow these simple steps:

- Gather all necessary financial data, including revenue, expenses, and other relevant information.

- Organize your data into the respective categories mentioned earlier (revenue, COGS, operating expenses, etc.).

- Calculate the values for each category by summing up the corresponding items.

- Subtract the COGS from the revenue to calculate the gross profit.

- Deduct the operating expenses from the gross profit to obtain the operating income.

- Account for any other income or expenses and include them in the appropriate category.

- Finally, subtract all expenses, including taxes, from the operating income to determine the net income.

Remember to use accounting software or spreadsheets to simplify this process and ensure accuracy.

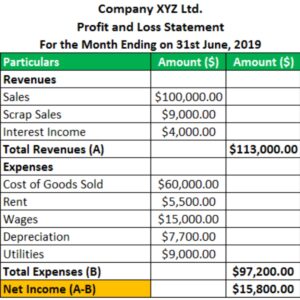

6. Example: Profit and Loss Statement for Small Business

Let’s explore an example of a profit and loss statement for a small business to better understand how it works.

7. Understanding the Example

[Provide a detailed explanation of the example profit and loss statement, highlighting important figures and insights]

8. Benefits of Using a Profit and Loss Statement

Profit and loss statements offer several benefits to small businesses:

- Financial Evaluation: They provide an accurate assessment of a business’s financial performance, allowing owners to make informed decisions.

- Identifying Profitability: By analyzing the statement, you can determine whether your business is profitable or running at a loss.

- Budgeting and Forecasting: Profit and loss statements aid in creating budgets, setting financial goals, and making projections for future growth.

- Investor and Lender Confidence: Lenders and investors often require profit and loss statements to evaluate a business’s financial health and potential for returns.

9. Downloadable Profit and Loss Statement Example (PDF)

For your convenience, we have prepared a downloadable profit and loss statement example in PDF format. Click here to access it and use it as a reference for creating your own statements.

10. Simple Profit and Loss Statement Example

While profit and loss statements can be comprehensive, a simplified version can be useful for quick analysis. Here’s an example of a simple profit and loss statement

11. Analyzing Restaurant Profit and Loss Statements

Restaurant businesses have unique considerations when it comes to profit and loss statements. Let’s explore the specific aspects of analyzing these statements for restaurants.

12. Common Mistakes to Avoid in Profit and Loss Statements

When preparing profit and loss statements, it’s crucial to avoid common mistakes that can lead to inaccurate financial insights. Some common mistakes to avoid include:

- Inaccurate Categorization: Ensure all revenue and expenses are correctly allocated to the appropriate categories.

- Omitting Expenses: Account for all expenses, even small ones, to get a comprehensive picture of your business’s financial health.

- Neglecting Depreciation: Include depreciation expenses to accurately reflect the wear and tear of your business assets over time.

- Ignoring Seasonal Variations: Take into account seasonal fluctuations in revenue and expenses for accurate analysis.

13. How Often Should You Review Your Profit and Loss Statement?

Regular review of profit and loss statements is vital to track your business’s financial progress effectively. As a general guideline, small businesses should review their profit and loss statements on a monthly basis. However, depending on your industry and business model, you may need to review them more frequently, such as on a weekly or quarterly basis.

14. Conclusion

In conclusion, profit and loss statements are indispensable tools for small businesses, providing insights into their financial performance. By understanding and utilizing these statements effectively, business owners can make informed decisions, optimize their operations, and drive profitability. Remember to regularly review and analyze your profit and loss statements to stay on top of your business’s financial health.

FAQs (Frequently Asked Questions)

1. How do I calculate net income from a profit and loss statement? To calculate net income, subtract all expenses, including taxes, from the operating income figure mentioned in the profit and loss statement.

2. Can I use accounting software to generate profit and loss statements? Yes, there are various accounting software options available that can automate the process of generating profit and loss statements for your small business.

3. Are profit and loss statements the same as balance sheets? No, profit and loss statements focus on a business’s revenues, expenses, gains, and losses over a specific period, while balance sheets provide a snapshot of a company’s assets, liabilities, and equity at a particular point in time.

4. What should I do if my business consistently shows a loss on the profit and loss statement? If your business consistently shows a loss, it’s essential to analyze the underlying causes. Consider adjusting your pricing, reducing costs, or exploring new revenue streams to improve profitability.

5. Can I hire a professional accountant to help me with profit and loss statements? Yes, engaging a professional accountant can provide valuable expertise and ensure accurate preparation and analysis of your profit and loss statements.

By following these guidelines and understanding the importance of profit and loss statements, you are equipped to navigate your small business’s financial landscape with confidence and make data-driven decisions for long-term success.